How to Transfer Money from Cash App to Apple Pay: A Comprehensive Guide

In today’s digital age, managing finances often involves juggling multiple payment platforms. Two of the most popular are Cash App and Apple Pay. While both facilitate easy money transfers and payments, they operate within their own ecosystems. This often leads to the question: How to transfer money from Cash App to Apple Pay? Unfortunately, a direct transfer isn’t possible. This article provides a comprehensive guide to navigate this limitation and explore alternative solutions.

Understanding the Limitations: Direct Transfer is Not Possible

Before diving into workarounds, it’s crucial to understand why a direct transfer between Cash App and Apple Pay isn’t available. Both platforms are designed as closed systems, prioritizing transactions within their own networks. This means that while you can send and receive money within Cash App and within Apple Pay, bridging the two directly isn’t a built-in feature.

This limitation stems from several factors, including proprietary technology, security protocols, and business strategies. Each platform wants to keep users within its ecosystem, encouraging them to use their services for all financial transactions. Consequently, users seeking to transfer money from Cash App to Apple Pay need to employ indirect methods.

Alternative Methods to Transfer Funds

While a direct transfer is off the table, several workarounds allow you to effectively move funds from your Cash App balance to your Apple Pay account. These methods involve using intermediary bank accounts or debit cards.

Using a Bank Account as an Intermediary

This is the most common and reliable method. It involves linking both your Cash App account and your Apple Pay account to the same bank account. Here’s how it works:

- Link your bank account to Cash App: Open Cash App, tap the profile icon in the top right corner, select “Linked Banks,” and follow the instructions to link your bank account.

- Transfer funds from Cash App to your bank account: On the Cash App home screen, tap the “Banking” tab (house icon), and then tap “Cash Out.” Enter the amount you want to transfer and select your linked bank account. Choose between standard (free, but takes 1-3 business days) or instant transfer (fee applies).

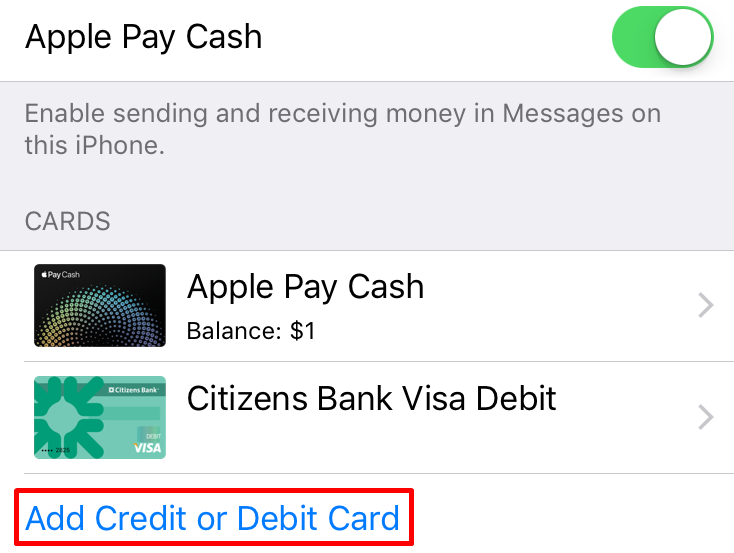

- Link your bank account to Apple Pay: Open the Wallet app on your iPhone, tap the plus (+) icon, and follow the instructions to add your bank account.

- Transfer funds from your bank account to Apple Cash (Apple Pay): Once your bank account is linked to Apple Pay, you can add funds to your Apple Cash card. Open the Wallet app, tap on your Apple Cash card, tap the three dots in the top right corner, and select “Add Money.” Choose the amount you want to add from your linked bank account.

This process effectively allows you to transfer money from Cash App to Apple Pay, albeit indirectly, by using your bank account as a temporary holding place.

Using a Debit Card as an Intermediary

Similar to the bank account method, you can use a debit card as an intermediary. This method is faster than using a bank account for standard transfers, but it might still involve fees depending on your Cash App settings.

- Link your debit card to Cash App: Open Cash App, tap the profile icon, select “Linked Banks,” and add your debit card.

- Transfer funds from Cash App to your debit card: On the Cash App home screen, tap the “Banking” tab, and then tap “Cash Out.” Enter the amount and select your linked debit card. Again, choose between standard or instant transfer.

- Add your debit card to Apple Pay: Open the Wallet app on your iPhone, tap the plus (+) icon, and add your debit card.

- Use the debit card within Apple Pay: With the debit card added to Apple Pay, you can use it for purchases or to send money to other Apple Pay users. While this doesn’t directly add funds to your Apple Cash balance, it allows you to utilize the money transferred from Cash App within the Apple Pay ecosystem.

While this method doesn’t directly transfer money from Cash App to Apple Pay in the form of adding to your Apple Cash balance, it allows you to use the funds through Apple Pay by using the debit card for transactions.

Comparing the Methods: Bank Account vs. Debit Card

Both methods achieve the goal of moving funds from Cash App to the Apple Pay ecosystem, but they have distinct advantages and disadvantages:

- Speed: Debit card transfers are generally faster, especially if you opt for instant transfers on Cash App. Bank account transfers can take 1-3 business days for standard transfers.

- Fees: Cash App charges a fee for instant transfers to both bank accounts and debit cards. Standard bank account transfers are free.

- Convenience: Both methods require linking accounts, but using a debit card might be slightly more convenient as it bypasses the waiting period for standard bank transfers.

The best method depends on your individual needs and priorities. If speed is crucial and you’re willing to pay a fee, a debit card transfer is the better option. If you’re not in a rush and want to avoid fees, a bank account transfer is the more economical choice.

Troubleshooting Common Issues

When attempting to transfer money from Cash App to Apple Pay using these methods, you might encounter some common issues:

- Incorrect Account Information: Double-check that you’ve entered the correct bank account or debit card information in both Cash App and Apple Pay.

- Insufficient Funds: Ensure you have sufficient funds in your Cash App balance to cover the transfer amount and any associated fees.

- Transfer Limits: Be aware of any daily or weekly transfer limits imposed by Cash App or your bank.

- Verification Issues: Both Cash App and Apple Pay may require you to verify your identity or account information before allowing transfers.

If you encounter any of these issues, consult the help sections of Cash App and Apple Pay or contact their customer support teams for assistance.

Security Considerations

When dealing with financial transactions, security is paramount. Here are some security considerations to keep in mind when attempting to transfer money from Cash App to Apple Pay:

- Use Strong Passwords: Use strong, unique passwords for both your Cash App and Apple Pay accounts.

- Enable Two-Factor Authentication: Enable two-factor authentication (2FA) on both platforms for an extra layer of security.

- Be Wary of Phishing Scams: Be cautious of phishing emails or messages that attempt to trick you into revealing your account information.

- Monitor Your Accounts Regularly: Regularly monitor your Cash App and Apple Pay accounts for any unauthorized activity.

By taking these precautions, you can minimize the risk of fraud and protect your financial information.

The Future of Payment Platform Interoperability

While direct transfers between Cash App and Apple Pay are currently not possible, the future of payment platform interoperability may bring changes. As digital payment systems continue to evolve, there may be increased pressure for platforms to become more open and allow for seamless transfers between different ecosystems. [See also: Future of Digital Payments]

However, for now, users must rely on the workaround methods described in this article to transfer money from Cash App to Apple Pay.

Conclusion

Although a direct transfer money from Cash App to Apple Pay isn’t an option, you can successfully move your funds using a bank account or a debit card as an intermediary. Understanding the nuances of each method, including the speed, fees, and security considerations, will help you choose the best approach for your needs. By following the steps outlined in this guide, you can navigate the limitations of these platforms and effectively manage your digital finances.