Cash App Flips: Unveiling the Risks and Realities Behind the Trend

The promise of quick riches has always been a potent lure, and in the digital age, that lure often manifests as online trends promising easy money. One such trend that has gained traction, particularly among younger users, is the concept of “Cash App flips.” These flips, often advertised on social media platforms like Instagram, TikTok, and YouTube, claim to offer users the opportunity to double or even triple their money in a short period. However, beneath the surface of these enticing offers lies a web of potential scams, financial risks, and legal consequences.

This article aims to dissect the phenomenon of Cash App flips, exploring what they are, how they operate, the inherent dangers they pose, and how to protect yourself from becoming a victim. We will delve into the mechanics of these “flips,” examine the red flags that should raise suspicion, and provide practical advice on safeguarding your finances in the digital landscape. Understanding the realities behind Cash App flips is crucial for making informed financial decisions and avoiding potentially devastating losses.

What are Cash App Flips?

Cash App flips are essentially investment schemes, often presented as a way to quickly multiply your money through the Cash App platform. Individuals or groups, often self-proclaimed “investment gurus” or “financial experts,” solicit users to send them a certain amount of money via Cash App with the promise of returning a significantly larger sum within a specific timeframe, typically hours or days. The allure is simple: invest a small amount and reap substantial rewards without any real effort.

These “experts” often claim to have access to special investment strategies, insider information, or algorithmic trading systems that guarantee high returns. They might showcase screenshots of purported successful transactions or testimonials from satisfied customers to further entice potential investors. However, the reality is often far different from the rosy picture they paint. The promised returns rarely materialize, and users are often left with nothing but a lighter wallet and a valuable lesson learned the hard way.

How Cash App Flips Operate

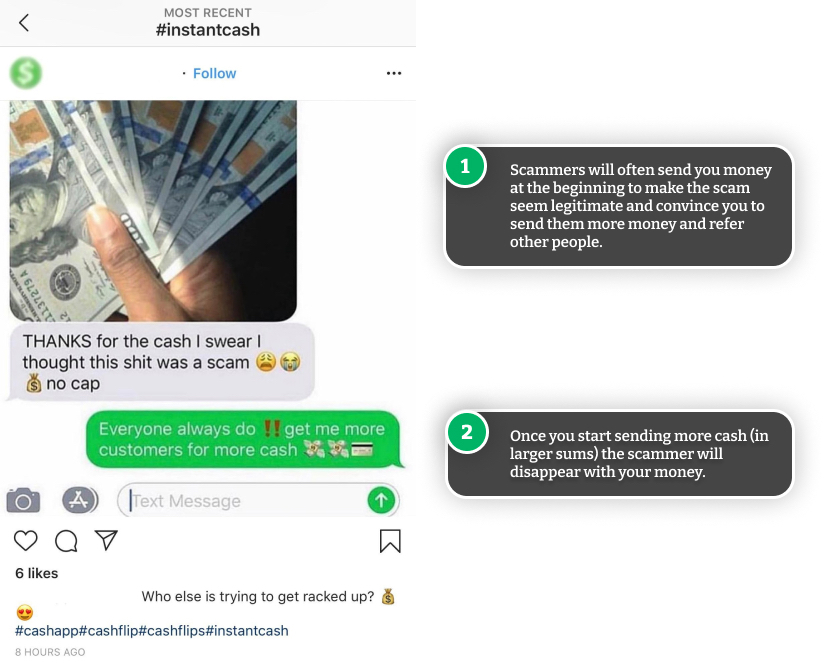

The mechanics of a Cash App flip typically follow a similar pattern. The “flipper” advertises their services on social media, often using eye-catching graphics, videos, and promises of guaranteed profits. They might target specific demographics, such as students or individuals struggling financially, who are more likely to be vulnerable to such schemes.

Once a user expresses interest, the flipper will typically request an initial investment, ranging from a few dollars to hundreds or even thousands of dollars. They might claim that this initial investment is necessary to cover transaction fees, access their exclusive investment platform, or unlock higher returns. After receiving the money, the flipper may initially provide some small returns to build trust and encourage further investment. This is a classic Ponzi scheme tactic, where early investors are paid with money from later investors, creating a false sense of legitimacy.

Eventually, the flipper will disappear with the remaining funds, leaving the investors high and dry. They might block the victim on social media, delete their accounts, or simply become unresponsive. In some cases, they might even try to extort more money from the victim by threatening to expose their involvement in the scheme or report them to the authorities.

The Dangers of Cash App Flips

Participating in Cash App flips carries significant risks, both financial and legal. Here are some of the most prominent dangers:

- Financial Loss: The most obvious risk is the loss of your initial investment. In most cases, users never see their money again.

- Scams and Fraud: Cash App flips are often scams designed to steal money from unsuspecting victims. [See also: Common Online Scams to Avoid]

- Identity Theft: In some cases, flippers might ask for personal information, such as your bank account details or social security number, which can be used for identity theft.

- Legal Consequences: Depending on the nature of the flip, you could be unknowingly involved in illegal activities, such as money laundering or fraud.

- Tax Implications: Even if you do manage to make a profit from a Cash App flip (which is highly unlikely), you might be required to pay taxes on those earnings. However, reporting illegal income can expose you to further legal scrutiny.

Red Flags to Watch Out For

Several red flags should raise suspicion when encountering a Cash App flip offer. If you spot any of these warning signs, it’s best to steer clear:

- Guaranteed Returns: Legitimate investments always carry some degree of risk. Anyone who guarantees a specific return is likely trying to scam you.

- Unrealistic Profits: Promises of doubling or tripling your money in a short period are highly unrealistic and unsustainable.

- Pressure to Invest: Scammers often use high-pressure tactics to convince you to invest quickly, without giving you time to think things through.

- Lack of Transparency: If the flipper is unwilling to provide detailed information about their investment strategy or credentials, it’s a sign that something is amiss.

- Requests for Personal Information: Be wary of anyone who asks for sensitive personal information, such as your bank account details or social security number.

- Poor Grammar and Spelling: Many scammers operate from overseas and may not have a strong command of the English language.

- Use of Generic Images and Videos: Scammers often use stock photos or videos to create a false impression of legitimacy.

How to Protect Yourself from Cash App Flip Scams

Protecting yourself from Cash App flip scams requires a healthy dose of skepticism and a commitment to responsible financial practices. Here are some tips to help you stay safe:

- Be Skeptical: If something sounds too good to be true, it probably is. Don’t fall for promises of easy money or guaranteed returns.

- Do Your Research: Before investing in anything, take the time to research the company or individual offering the investment. Check their credentials, read reviews, and look for any red flags.

- Never Share Personal Information: Be extremely cautious about sharing personal information online, especially your bank account details or social security number.

- Report Suspicious Activity: If you encounter a Cash App flip offer, report it to Cash App and the relevant social media platform.

- Educate Yourself: Learn about common scams and how to avoid them. The more you know, the better equipped you’ll be to protect yourself.

- Use Strong Passwords and Enable Two-Factor Authentication: Protect your accounts with strong, unique passwords and enable two-factor authentication whenever possible.

- Trust Your Gut: If something feels off, trust your instincts. It’s always better to err on the side of caution.

Cash App’s Stance on Flips

Cash App explicitly prohibits the use of its platform for illegal or fraudulent activities, including Cash App flips. Their terms of service clearly state that users are responsible for ensuring that their transactions are legitimate and comply with all applicable laws and regulations. Cash App actively monitors its platform for suspicious activity and takes action against users who violate its terms of service. However, due to the sheer volume of transactions processed daily, it can be challenging to identify and prevent all fraudulent activity. Therefore, it’s essential for users to be vigilant and take proactive steps to protect themselves.

Legal Ramifications of Participating in Cash App Flips

Beyond the financial risks, participating in Cash App flips can also have legal consequences. Depending on the specific circumstances, you could be charged with crimes such as fraud, money laundering, or conspiracy. Even if you are not directly involved in the fraudulent activity, you could be held liable for aiding and abetting the scammers. It’s crucial to understand that ignorance of the law is not a defense, and you could face serious penalties, including fines and imprisonment, for participating in illegal activities, even unknowingly. [See also: Understanding Financial Fraud Laws]

Alternatives to Cash App Flips

If you’re looking for legitimate ways to grow your money, there are many safer and more reliable alternatives to Cash App flips. These include:

- Investing in Stocks and Bonds: While investing in the stock market involves risk, it offers the potential for long-term growth and diversification.

- Saving Accounts and CDs: Savings accounts and certificates of deposit (CDs) offer a safe and secure way to earn interest on your money.

- Real Estate Investing: Investing in real estate can provide a steady stream of income and appreciation over time.

- Starting a Business: Starting your own business can be a rewarding way to generate income and build wealth.

- Learning a New Skill: Investing in your education and skills can increase your earning potential and open up new opportunities.

Conclusion

Cash App flips represent a dangerous trend that preys on the desire for quick riches. While the promise of easy money may be tempting, the reality is that these “flips” are often scams designed to steal money from unsuspecting victims. By understanding the risks involved, recognizing the red flags, and taking proactive steps to protect yourself, you can avoid becoming a victim of these fraudulent schemes. Remember, there are no shortcuts to wealth. Building financial security requires patience, discipline, and a commitment to responsible financial practices. Always be skeptical of offers that seem too good to be true, and never invest money that you can’t afford to lose. Staying informed and vigilant is the best defense against the ever-evolving landscape of online scams.